Werner Salzmann promised a sequel to his volume “Your identity card, please!” A survey of a special field of French fiscal philately, which deals exclusively with the special field of identity cards. Now the follow-up is available: two volumes with almost 800 pages have been published. They cover the entire panorama of French fiscal philately, even more comprehensively and diversely than the first part of the trilogy.

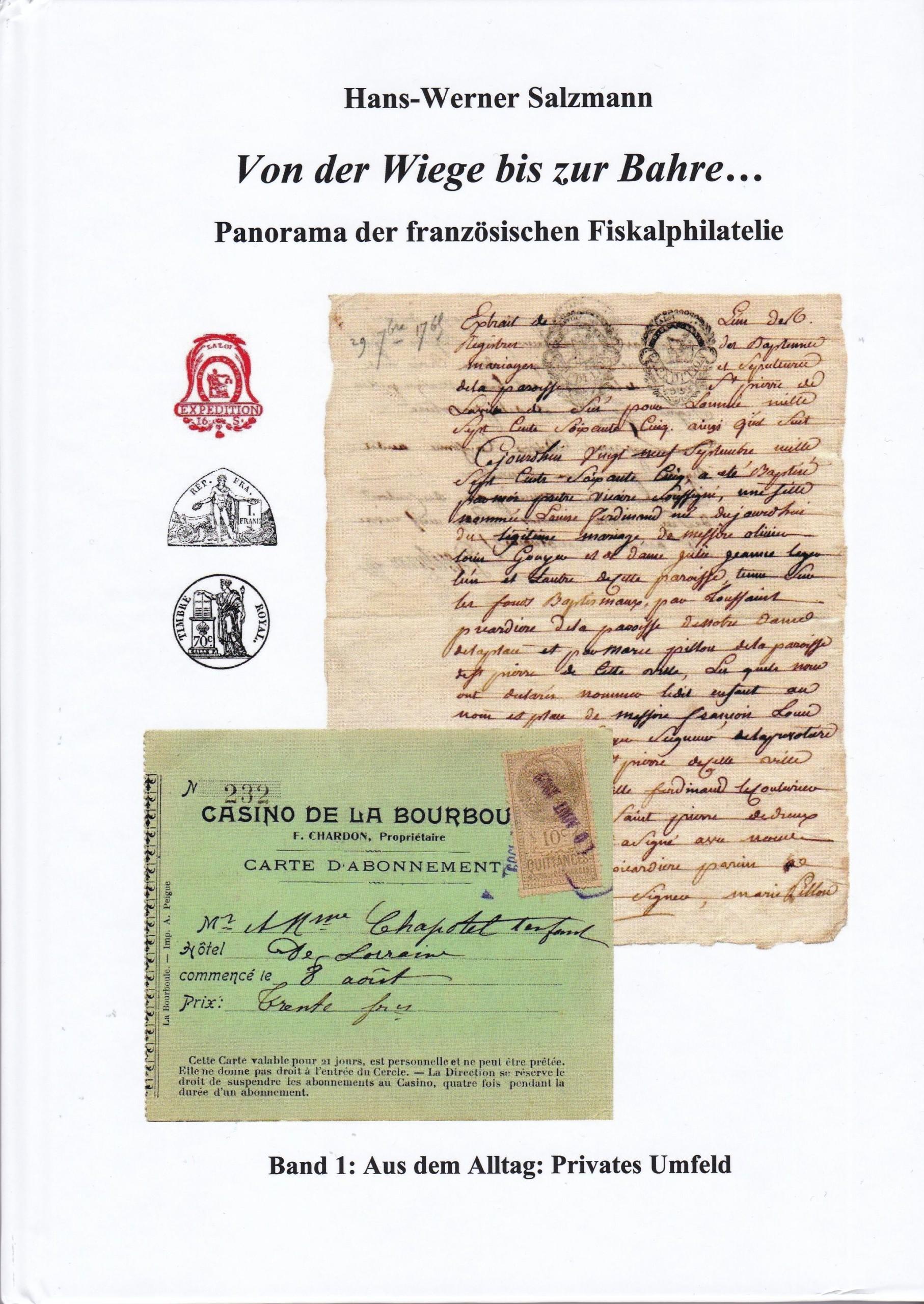

Volume 1 Everyday life is dedicated to the private sphere. It deals with documents that are required for decisive events in life: birth, marriage with the preparatory banns and subsequent marriage contract, certificates in the case of death, burial permit, grave rental and finally the will. Again and again, certified declarations are necessary in daily life: certificate of good conduct, powers of procuration, court file transcripts, contracts of sale, tenancy agreements and receipts for rent payments. In all these cases, a fee is incurred, which is materialised with a tax (stamp) mark. But leisure activities also need to be “officially” recognised: think of the fishing permit, the hunting permit, the boating licence, purchase cards for tobacco products in times of war, and the French treasury even knew how to levy a tax on admission to the casino and on playing cards.

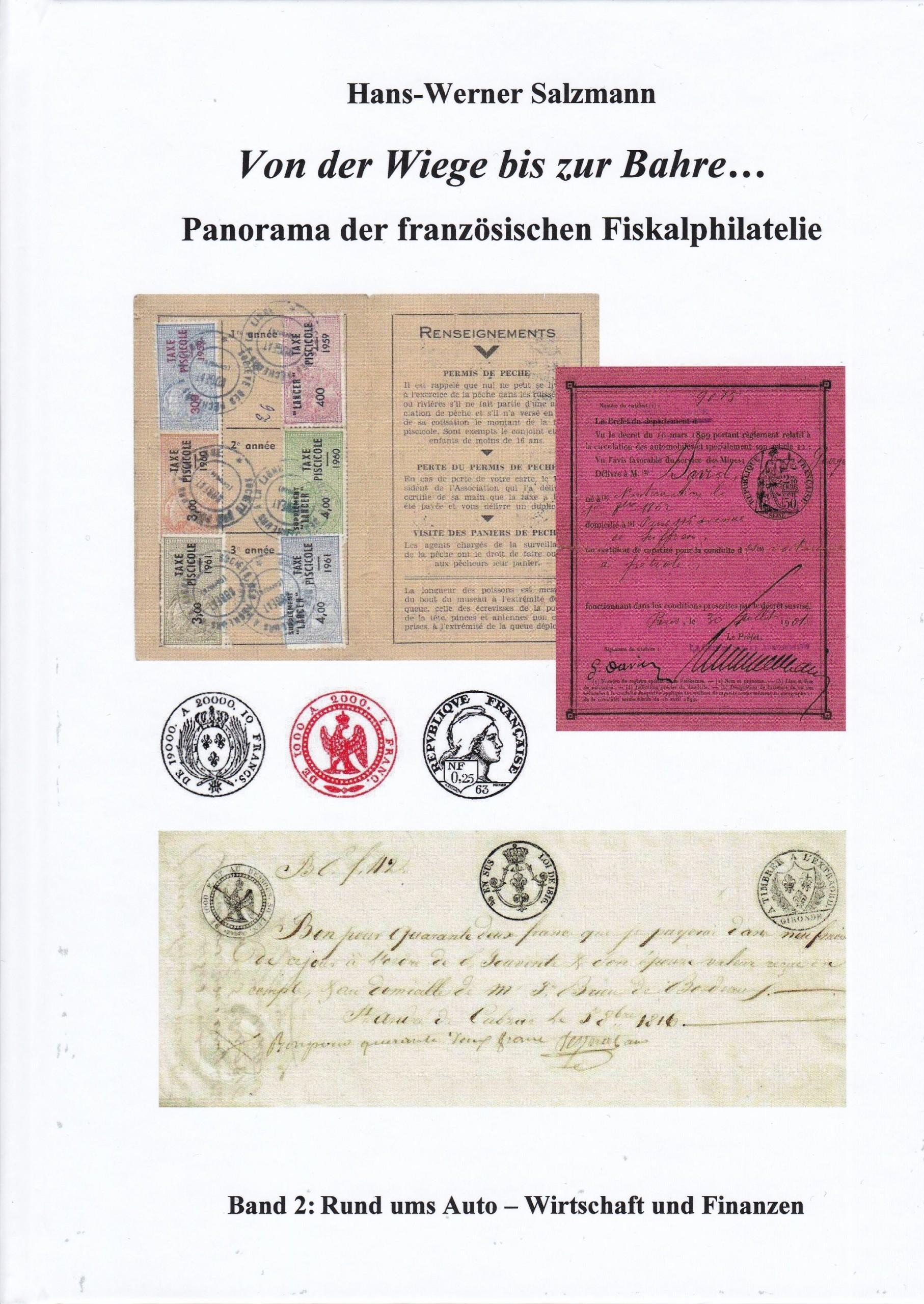

Volume 2 stretches the spectrum further and turns to the car/vehicle in the first part. Here there were countless opportunities for the state to intervene. In order to take the driving test, the candidate had to present a medical certificate of health, issued for a fee. The driving licence was also subject to taxation, graded according to motorbike and automobile. Only the international driving licence was even more expensive. The vehicle itself had to be registered for road traffic, and the road user had to arrange an insurance policy. The membership card in the automobile club carried a tax stamp, and if a driver received a penalty notice, there was also a separate category of tax vignette for this purpose, which “facilitated” payment. Bicycles were similarly taxed and carried a metal badge valid for one year, which was later replaced by an identification card with a tax stamp.

The next part of volume 2 is about finance, trade and economy. Here, all kinds of stamp papers come into the picture. They were used for issuing deeds, contracts, certificates, public announcements and so on. The fees were calculated according to the size of the paper, and the maximum number of lines was precisely fixed. Originally, these were dry (blind) stamps or wet stamps, which in the course of time gave way to rubber stamps. Receipts, bills of exchange, cheques, stock exchange papers, shares and bonds fall into this category, as do bills of exchange and waybills, regardless of whether they were made out for shiploads or goods traffic. Newspapers and advertising journals of all kinds were also subject to the dimensional tax. Travel documents are a world apart. For many years, airline tickets carried revenue stamps, and in the beginning even railway tickets. Finally, there are the so-called indirect taxes. They are not levied on the goods themselves, but on their use, e.g. matches, lighters, drink coupons or salt. Luxury taxes should not be forgotten, which were sometimes disguised as protective tariffs or even had an ethical justification: they were intended to counteract unreasonable expenditure on clothing and food and to maintain social peace. This can perhaps still be understood in the case of champagne. But what when even the coffee substitute chicory is also subject to a special tax? – A final extensive section of more than sixty pages deals with the development and use of tax stamps through the centuries.

What is impressive in both volumes is the immense breadth and abundance of the material presented. Perhaps this explains the strong fascination with fiscal philately today, which is attracting many new followers. Reading the book reminded the reviewer a little of a glider flight, where the landscape changes continuously and hardly leaves time for intensive observation. Thus Salzmann’s legends to the illustrated covers are to a large extent descriptive and do not include a detailed analysis of why, for example, this or that category of revenue stamp was used or when a certain tariff was introduced. One will look in vain for such tables. Instead, he provides a lot of historical, social and cultural background information. For example, he goes into detail about the introduction of the stamp duty or the administrative structure of the Ancien Régime, he provides biographical information on Gervais Pigier, the founder of the first professional commercial school, or he explains that a table bill of a restaurant in Bayeux, which is equipped with revenue stamps, certainly belonged to tourists who visited the famous tapestry there. He often intersperses contemporary engravings or postcards, which not only enliven the text and illustrations, but also complement them. And time and again he looks “beyond the end of his nose”. He does not limit himself to the mother country, but also presents many documents for the French colonies, or he shows how, for example, the bicycle tax was declared in other countries or how colourful hunting licences look in the United States of America. In this way, the result is not a dry non-fiction book, but an informative compendium on French regional and cultural history starting from fiscal philately. Pleasant reading is guaranteed!

SALZMANN, Hans-Werner, „Von der Wiege bis zur Bahre…“ Panorama der französischen Fiskalphilatelie. Band 1: Aus dem Alltag: Privates Umfeld. Band 2: Rund ums Auto – Wirtschaft und Finanzen. [“From the cradle to the grave…”. Panorama of French fiscal philately. Volume 1: Everyday Life: Private environment. Volume 2: All about the car – economy and finance.] Formate 17.5 x 24.5 cm, all in all 795 Seiten. Farbige Abb., Hardcover mit Fadenheftung. Essen: Eigenverlag, 2022. Price: per vol. 32 € + shipping, both vols. as a bundle 60 € incl. shipping. Available from: Hans-Werner Salzmann, Saalestraße 13, 45136 Essen. E-mail: hws-nrw@t-online.de.

Rainer von Scharpen, AIJP